Freedom in Five: Your Financial Independence Blueprint

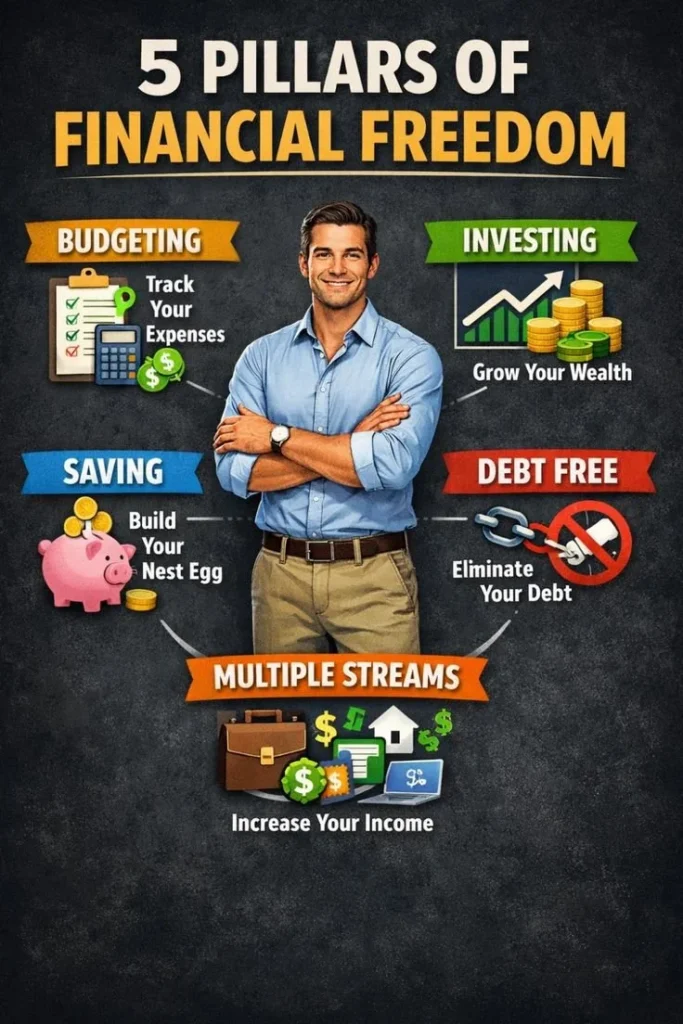

Achieving financial independence doesn’t require a secret formula — it requires a plan, consistent action, and occasional course corrections. This article lays out five focused steps you can take to build wealth, protect it, and ultimately create the freedom to choose how you spend your time. For a deeper framework that complements this approach, consider how the five pillars of financial freedom align with long-term goal setting.

Step 1 — Define Clear Goals and Master Your Mindset

Start by defining what financial independence looks like for you: a timeline, a target number, and the lifestyle you want. Break big goals into quarterly milestones and celebrate progress. Wealth is as much psychological as numerical; build habits, remove instant-gratification triggers, and commit to a repeatable routine — much like following a focused fitness challenge, such as the 30-day arms plan, to develop discipline and measurable gains.

Step 2 — Control Cash Flow: Budget, Reduce Expenses, and Build an Emergency Fund

Track every dollar for one month, then create a simple budget that prioritizes savings and debt repayment. Cut wasteful recurring costs and renegotiate bills where possible. Aim for a 3–6 month emergency fund: liquidity protects your progress and prevents setbacks when life surprises you.

Step 3 — Eliminate High-Interest Debt and Optimize Payments

Tackle high-interest debt first using either the avalanche (highest rate) or snowball (smallest balance) method — pick whichever keeps you consistent. Refinance where sensible and automate minimum payments to avoid late fees. As you free up cash, redirect it into investments or income-generating projects; think of diversifying efforts the way you diversify training routines, inspired by resources like the best ab workouts that combine approaches for balanced results.

Step 4 — Invest Consistently and Build Multiple Income Streams

Allocate a fixed percentage of income to retirement accounts, taxable investments, and a growth bucket for higher-risk opportunities. Use dollar-cost averaging, keep fees low, and favor diversified ETFs or index funds if you prefer passive investing. Parallel to investing, cultivate side income — freelancing, a small online business, or rental income — to speed your path to independence and reduce reliance on any single source.

Step 5 — Automate, Protect, and Live Intentionally

Automate savings, bill payments, and investments so your plan runs without daily effort. Protect gains with appropriate insurance, an estate plan, and an emergency cash buffer. Remember to plan withdrawal strategies and tax-efficient distributions once you approach independence. Keep your lifestyle choices aligned with your goals — small, intentional pleasures beat expensive drift. Treat long-term protection and routine-building the way athletes follow a comprehensive program like the Transform Your Body program: consistent, layered, and designed to last.

Conclusion

Financial independence is a practical journey of five core steps—set goals, control cash flow, remove debt, invest and diversify income, then automate and protect your progress. For an important complementary perspective on the mindset side of freedom, read The Mental Wealth Blueprint: 5 Steps To Psychological Freedom.